Worried about the Mt. Juliet city tax increase? Here’s a simple breakdown of what’s changing, how it affects your property tax bill, and why social media might be getting it wrong.

Mt. Juliet Just Raised City Taxes—Now What? A Quick Breakdown of What That Means and How It Might Affect You

OK, it’s official—Mt. Juliet just approved an increase in city property taxes. If you’ve been on Facebook lately, you’ve probably seen some passionate opinions, confused comments, and maybe even a few claims that your property taxes are about to quadruple.

Let’s hit pause on the panic and break this down as simply as possible.

The Basics of the Tax Increase

The new city property tax rate in Mt. Juliet is $0.29 per $100 of assessed value. That change was voted on and passed this week, and yes—it means an increase in what you’ll pay. But is your tax bill going to triple or quadruple like some folks online are saying?

Not even close.

Here’s where a lot of the confusion starts:

Most people don’t realize that your total property tax bill is made up of county taxes + city taxes. And in Mt. Juliet, city taxes usually make up only about 5% of your total bill. So when the city rate increases, it has a relatively small impact on the full amount you pay.

Let’s Use a Real Example

Let’s say last year your combined city + county property tax bill was $2,500.

Some of the rumors floating around are making people think that number is going to jump to $10,000.

That’s just not true.

Here’s a real-world example:

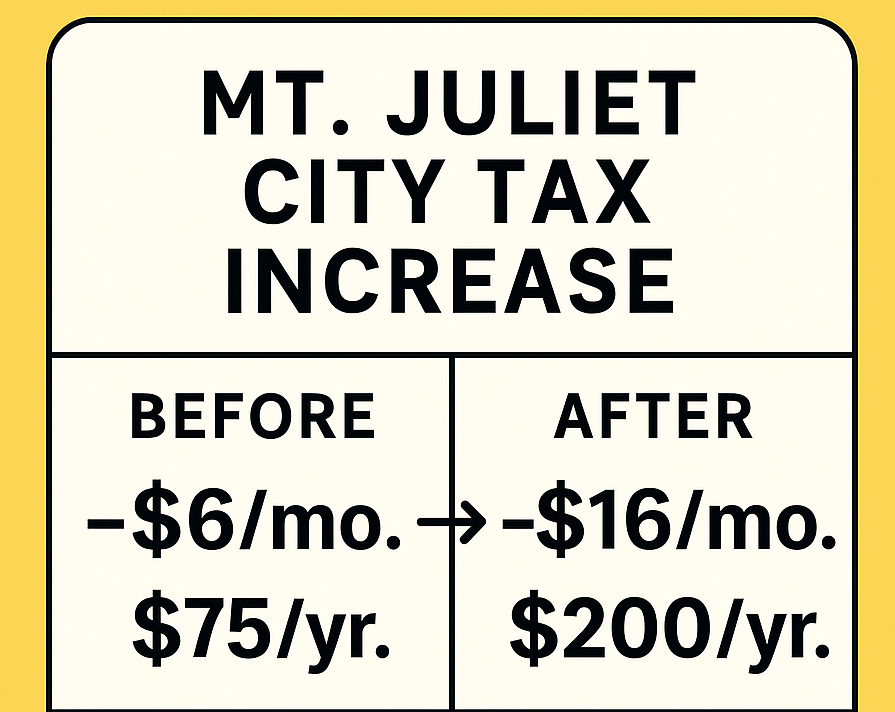

I live here in the city of Mt. Juliet. Last year, my city taxes were around $75 for the year. Under this new rate, they’re going to go up to about $200 a year. That breaks down to:

- Before: ~$6/month

- After: ~$16/month

- $10 to $12 more per month.

Quick Note on Assessed Value

One more important detail: this new tax rate is based on 25% of your property’s assessed value, not what you paid for the home or the current market value. The county assesses property values using their own formulas, which can often be lower than what your house would actually sell for.

So again, even with this increase, we’re still looking at one of the lowest city tax rates in the state of Tennessee.

Why This Is Happening Now

Here’s the truth: Mt. Juliet has avoided raising city taxes for years. Many believe there should have been smaller, more gradual increases along the way. Instead, we’ve reached a point where a more significant jump had to happen all at once to keep up with growth and demand for services.

Final Thoughts

Nobody wants to pay more in taxes—I get it. If you’re a Mt. Juliet resident, this new rate will likely cost you an extra $10 to $15 per month. And that’s still with the city portion being just a small sliver of your total tax bill.

If you have questions about how this impacts your specific home—or if you’re thinking about buying in Mt. Juliet and want to understand how property taxes factor into your budget—I’m always happy to break it down for you.

Shoot me a message anytime. Let’s make sense of the numbers together.